The Big Trends - Part 7: Tech Innovations In Advertising, Education and Agriculture

"Nothing is impossible. We merely don't know how to do it yet." – Thomas Edison

We are now seven weeks into our ‘Big Trends’ series. This week we are looking at how technology has, and is, disrupting a few important industries, namely advertising, education and agriculture.

So let’s dive in!

🎧 Would you prefer to listen to these insights? Checkout the audio recording on Spotify and Apple Podcasts !

AdTech - Increasing Effectiveness Of Advertising Budgets

The advertising industry has undergone a secular shift over the last 2 decades, and that trend is going to continue.

Global advertising revenue is expected to top $800 billion in 2023 , with around 60% going to digital advertising. The chart below shows where ad dollars are, and aren’t going. The usual suspects are still in decline.

Global Media Budget Plans for 2023 - Image Credit: Marketingcharts.com

It’s no secret that Alphabet and Meta Platforms have used technologies like AI and big data to build the biggest ad platforms in the world. But there are other companies leveraging these technologies to build very profitable companies too.

Advertising via traditional mediums (newspapers, satellite and cable TV and radio) has two major problems. Firstly, an ad’s effectiveness is difficult to measure. Secondly, advertisers have to pay to broadcast their ads to the medium’s entire audience, many of whom may not be in the advertiser’s target market.

Both of these problems can be minimized with digital ads. Digital ads can be precisely targeted to consumers based on their demographics, interests and purchase history. They can also be tested and measured based on engagement and in some cases direct sales. Advertisers can then refine a campaign until they have optimized the ROI (return on investment) before scaling it up.

When advertisers know a campaign has a positive ROI, they can increase their budgets. So in aggregate, more effective advertising tools lead to growing ad budgets and a bigger market.

The biggest winners here are the platforms with the largest audiences, namely Meta , Alphabet , Amazon , Tencent and Bytedance (TikTok). These companies provide their own tools to help advertisers manage ad campaigns, but companies also need to manage their budgets across multiple platforms.

Demand side platforms like The Trade Desk allow advertisers to plan and run campaigns and buy ad space across multiple channels. Adobe also offers a demand side platform besides providing the tools that many creatives use to create ads.

Sell-side platforms like Magnite and Pubmatic help media channels and content creators sell ads. Roku operates on both sides, bringing viewers, media channels and advertisers together.

Some of the other companies that provide services around digital advertising include Digital Turbine , HubSpot , DoubleVerify , LiveRamp and Perion Network .

And yes, there’s an ETF too. The SmartETFs Advertising & Marketing Technology ETF is focussed on both advertising and marketing tech companies, so it includes CRM providers like Salesforce .

Streaming platforms like Netflix are also getting into the ad arena and competing for ad budgets with ad supported subscription plans. They published a Netflix 2023 “Upfront” piece in May this year and covered some of the metrics in the advertising business, which were quite impressive for a business that’s 6 months old.

However, that doesn’t mean the space is getting too crowded either. Advertisers are moving their budgets away from cable and satellite networks which are seeing their audiences decline.

According to ResearchandMarkets , the global market for digital ads is expected to grow at 14.7% annually from 2022 to 2027. They attribute this growth rate directly to a sharp increase in smartphone penetration, internet users worldwide and social media adoption.

EdTech - More Ways To Learn

Like a lot of tech industries, the EdTech (Education Technology) space accelerated during the Covid pandemic. But the interest didn’t end there and EdTech startups managed to raise $10.6 billion in 2022, a year when venture capitalists backed away from many other areas.

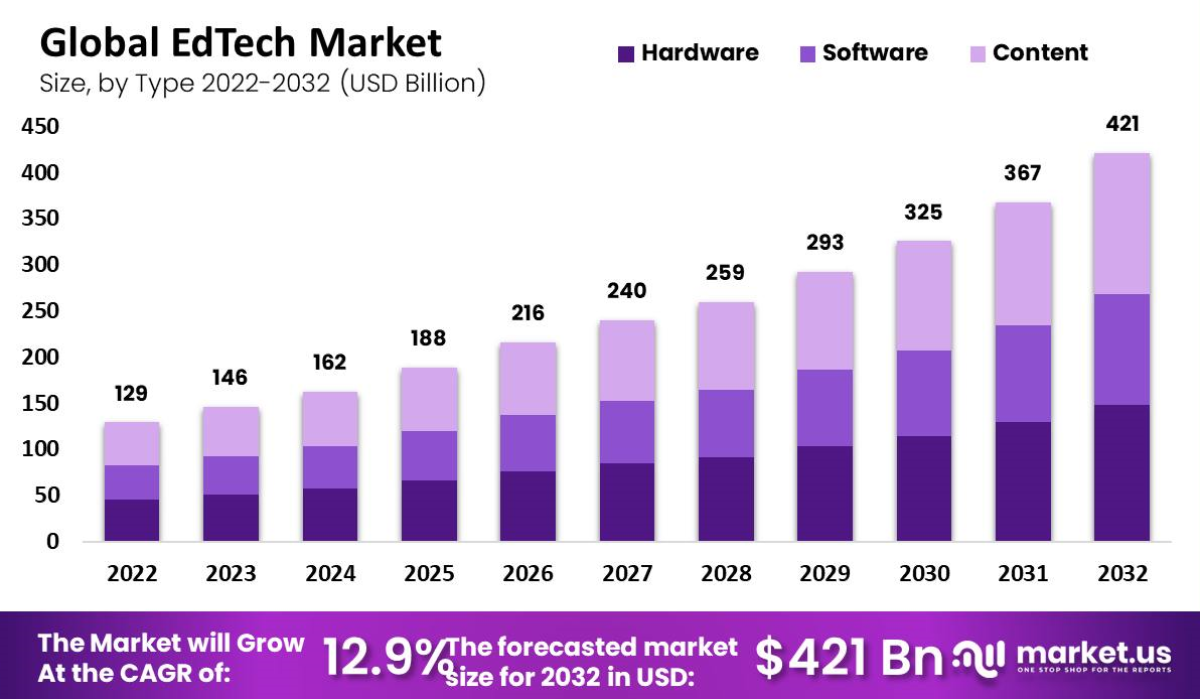

The forecasts below show the global edtech market is expected to almost triple in size over the next decade.

Global EdTech Market Forecasts - Image Credit: GlobalNewsWire.com

There’s far more to edtech than online learning. Some examples include:

- Programs can be personalized according to a learner's strengths and weaknesses.

- Students can progress at their own pace and around a flexible schedule.

- Edtech solutions can be scaled up to reach millions of people at an affordable price.

EdTech solutions can and are being used to complement traditional education at the school, college, or university level. But they are also becoming invaluable for adult education.

Jobs are evolving, new skills are needed and entirely new careers are emerging. This has prompted millions of people to enroll on platforms like Coursera and Udemy to learn specific skills by completing short courses, on a flexible schedule.

Like anything that gets ‘digitized’, online learning platforms generate data, and that data can be used to refine the process and improve outcomes. All the major tech innovations including AI, big data analysis, augmented reality, and even the metaverse, could be used to improve educational outcomes - and potentially reduce costs too.

Have a look at our Top EdTech Stocks collection for a few more ideas in the space.

AgTech - Innovations In Our Food Production

AgTech isn’t really a new concept at all. Last week we looked at the use of automation and robotics in agriculture . This is really a continuation of a trend that started amongst ancient civilizations and continued through several industrial revolutions; namely mechanizing tasks that were previously performed by hand.

While this automation continues, other technologies are being deployed to improve efficiency by

growing more with less land, water, and nutrients. To do this, startups and large companies alike are experimenting with technologies ranging from AI, to computer vision, 5G networks, and drones.

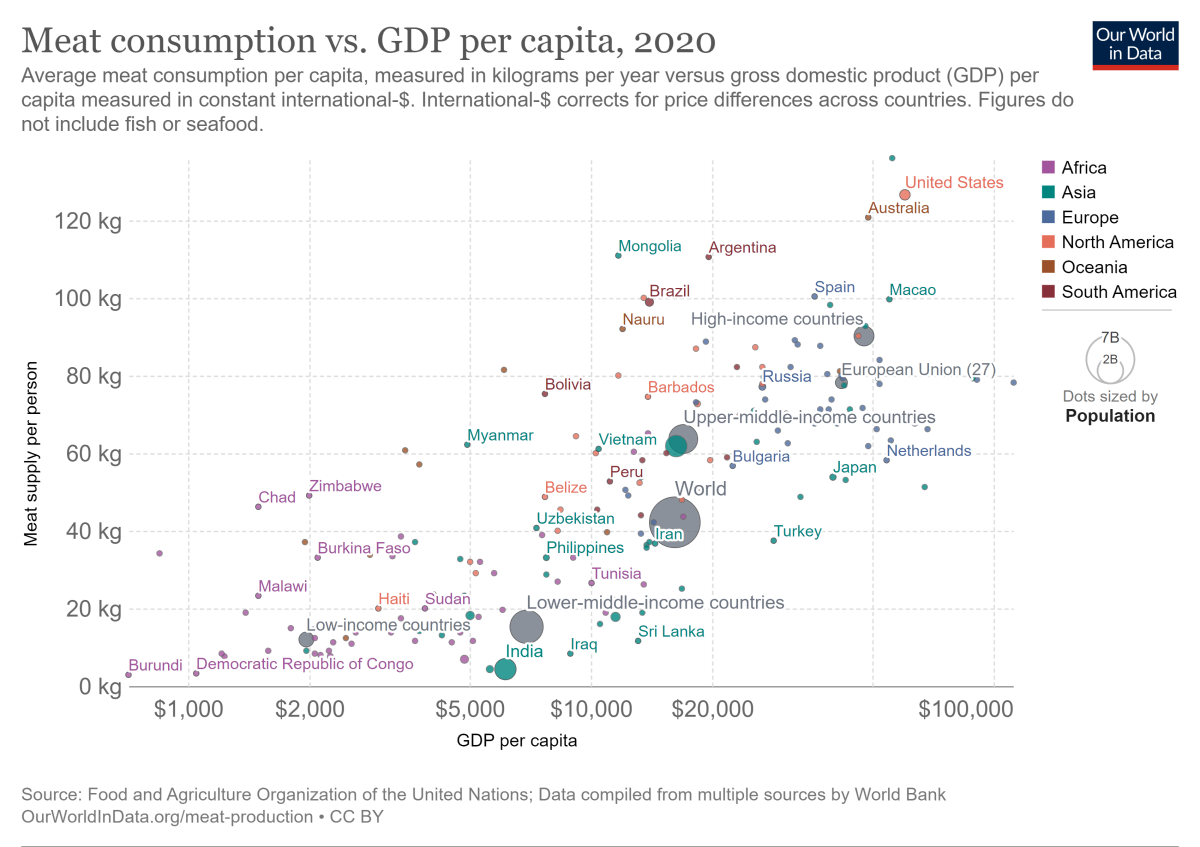

The tailwind behind tech innovation in agriculture is the fact that the world’s population is still growing, and incomes in the developing world are increasing too. When incomes increase, protein consumption increases too. This inevitably means that food production will have to increase too, in the face of land and water scarcity, and climate change.

Meat Consumption vs GDP per Capita by Country - Image Credit: Ourworldindata.org

Here are just a few examples of where agriculture may be headed:

- Canadian startup, ReelData AI uses computer vision to monitor individual fish in aquaculture farms. The system is used for early detection of diseases and to optimize feeding to avoid waste.

- Bee Vectoring Technologies uses bees to distribute a naturally occurring fungus that fights crop diseases and pests.

- Bird Control Group sells ‘laser scarecrows’ that can startle birds (harmlessly) when they are close to crops.

- Trace Genomics uses DNA extraction and machine learning to provide data and insights from soil samples.

These companies are startups or relatively small private companies, so aren’t relevant to public market investors, at least not yet. But there are thousands of similar startups experimenting with new ideas around the world, and it seems likely they will have an impact on food production in the years to come.

For now, investors are limited to the more traditional groups of larger listed companies, including:

- Food producers like Tyson Foods

- Fertilizer producers including Nutrien

- Companies that provide seed and crop protection: Corteva and FMC

- Farm machinery makers like Deere & Company and CNH Industrial N.V

These companies will have to embrace the types of innovative solutions listed above (or acquire those startups), and how they do that will determine their competitive position in the future.

So, while AdTech is now a mature industry, and EdTech is gathering momentum, the really innovative solutions in AgTech are only just emerging - but those tailwinds should be around for decades.

What Else is Happening?

First a recap of the key data releases we mentioned last week…

- 🇨🇳 China’s central bank cut the country’s one year interest rate for the fifth time since 2021, but unexpectedly left the five year rate unchanged.

- While the rest of the world is still fighting inflation China is facing deflation and an economic slump.

- 🇳🇿 New Zealand’s retail sales fell 1% during the second quarter as higher rates continued to take their toll.

- Economists now believe GDP growth during the second quarter may have been lower than expected.

- 🇪🇺 In Europe the HCOB PMI Flash Indexes were slightly weaker than expected.

- Manufacturing demand was better than expected, but weak estimates from the services sectors weighed on the composite index.

And then, a few news items that we thought were worth noting…

- Nvidia’s second quarter results were one of the most anticipated of the year, and the company didn't disappoint. The key number, data center revenue, was $10.3 billion, 28% higher than expected.

- The company also expects third quarter revenue to be around $16 billion, up from $13.5 billion in the last quarter.

- Clearly the demand for AI chips is very real. The question now is how well Nvidia , and its manufacturer TSMC will be able to keep up with demand.

- BHP Group , one of the world’s top iron ore producers, reported a 37% drop in full year profits. The company reported a 23% drop in profits from iron ore, with even bigger declines from coal and nickel.

- BHP’s profits were impacted by lower commodity prices, rather than lower volumes.

Key Events During the Next Week

Trade data dominates over the next week with the balance of trade figures in Germany on Tuesday, and Australia and China on Thursday.

Australia’s interest rate decision is due on Tuesday, followed by second quarter GDP data on Wednesday.

And then to end the week, Canada’s employment data will be published on Friday.

Second quarter earnings season is winding down, but there are still some key cloud software companies and discount retailers due to report:

- NIO Inc.

- Pinduoduo

- Best Buy

- Big Lots

- Ambarella

- CrowdStrike

- Salesforce

- Okta

- Chewy

- Veeva Systems

- Dollar General

- UBS AG

- Broadcom

- Lululemon

- MongoDB

- SentinelOne

- Dell Technologies

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Richard Bowman and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Richard Bowman

Richard is an analyst, writer and investor based in Cape Town, South Africa. He has written for several online investment publications and continues to do so. Richard is fascinated by economics, financial markets and behavioral finance. He is also passionate about tools and content that make investing accessible to everyone.