Stock Analysis

- United States

- /

- Auto

- /

- NasdaqGS:TSLA

Where is the Intrinsic Value Support for Tesla, Inc. (NASDAQ:TSLA)

Key takeaways:

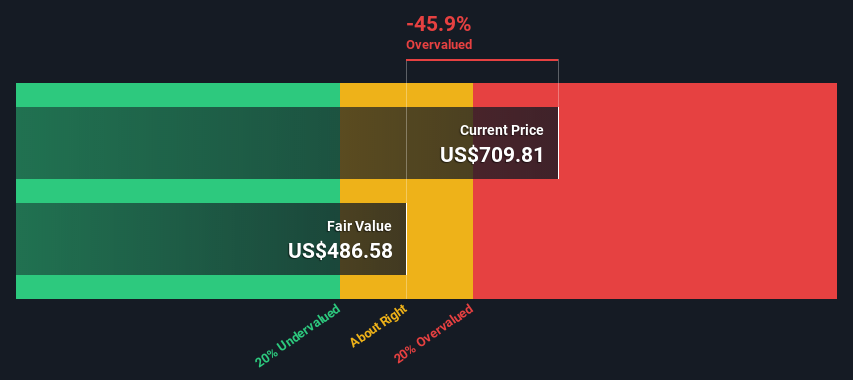

- 45% of Tesla's market cap may be exposed if investors decide to pull back to intrinsic value

- 37% of Tesla's shares are held by retail investors that may tolerate more pressure than the institutions

- Tesla is expected to continue growing revenue at 20% per year

Tesla, Inc. (NASDAQ:TSLA) was one of the most optimistic growth stories of 2021. With investors having strong opinions on both sides of the debate regarding the value of the stock.

While the stock may have been highly overvalued in 2021, today we will revisit the company and factor-in both the growth of key fundamentals, as well as the price drop and see how Tesla ranks on intrinsic value.

Tesla has been successfully growing despite supply chain and raw material challenges. The company is focused on developing its Austin, Berlin and Shanghai gigafactories, while delivering an impressive 48.7% 5-Year CAGR in revenues.

Just in the last 12 months, Tesla grew revenues 73%, while implementing efficiencies that make revenues grow 13% more than COGS. This means that the company is scaling well on the gross profit side.

Tesla currently has a gross margin of 27.1%, and a net profit margin 13.5%. The company grew from being barely profitable in 2020 to having US$8.4b net income in the last 12 months, and analysts expect that number to rise to US$22.8b in 2025.

Tesla's Intrinsic Value

The Tesla valuation is highly disputed amongst analysts and investors, so we are not going to be offering a perspective on the true value, rather it is a rough model based on analysts' future estimates and some model assumptions, so take it with a grain of salt.

A DCF attempts to value the cash generating capacity of operations. This means that we need to estimate future cash flows and see how much they are worth today by applying a discount for the opportunity cost of the investment.

View our latest analysis for Tesla

We start from analysts' future estimates and compute their present value:

10-year free cash flow (FCF) estimate

| 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 | 2031 | |

| Levered FCF | US$9.29b | US$14.5b | US$17.9b | US$23.4b | US$30.1b | US$35.1b | US$39.4b | US$43.0b | US$46.1b | US$48.6b |

| Growth Rate Estimate Source | Analyst x18 | Analyst x15 | Analyst x13 | Analyst x8 | Analyst x5 | Est @ 16.76% | Est @ 12.31% | Est @ 9.19% | Est @ 7.01% | Est @ 5.48% |

| Present Value Discounted @ 8.6% | US$8.6b | US$12.3b | US$13.9b | US$16.8b | US$19.9b | US$21.4b | US$22.1b | US$22.2b | US$21.9b | US$21.3b |

("Est" = FCF growth rate estimated by Simply Wall St)

Present Value of 10-year Cash Flow (PVCF) = US$180b

After calculating the present value of future cash flows in the initial 10-year period, we need to calculate the Terminal Value, which accounts for all future cash flows beyond the first stage.

Terminal Value (TV)= FCF2031 × (1 + g) ÷ (r – g) = US$49b× (1 + 1.9%) ÷ (8.6%– 1.9%) = US$740b

Present Value of Terminal Value (PVTV)= TV / (1 + r)10= US$740b÷ ( 1 + 8.6%)10= US$324b

The total value is the sum of cash flows for the next ten years plus the discounted terminal value, resulting in the Total Equity Value, which in this case is US$504b or US$487 per share.

Conclusion

It seems that about 45% of the current value is exposed to a possible correction should investors decide to pull back to value. Given that Tesla is a growth stock that is successfully executing, the intrinsic value of the company will keep rising and can converge to the market value if the company performs with expectations.

Besides the intrinsic value, the stock can be moved by other factors, such as the % of people actively trading it. In the case of Tesla, the public owns 37% of the shares, insiders (mostly Musk) have 17%, and the rest (45%) is held by institutions. Normally, institutions hold 70%+ of large cap stocks, but the high % of shares being held by the public can indicate that the company has loyal investors that may tolerate a larger pullback than institutions.

Finally, the fundamentals are still strong, and as long as Tesla keeps growing at high rates, investors will have a reason to believe in the company.

Keep in mind that today we didn't analyze the risks of the company, and you may want to check them against your investment thesis.

What are the risks and opportunities for Tesla?

Tesla, Inc. designs, develops, manufactures, leases, and sells electric vehicles, and energy generation and storage systems in the United States, China, and internationally.

Rewards

Earnings are forecast to grow 22.26% per year

Risks

High level of non-cash earnings

Further research on

Tesla

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Goran Damchevski and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.